Want to learn more?

Home » Insights » Retirement » Your Retirement Checklist for Ages 50, 60, 65, and Beyond

Whether you’re planning your retirement or already retired, this checklist can help track financial success at age 50 and beyond.

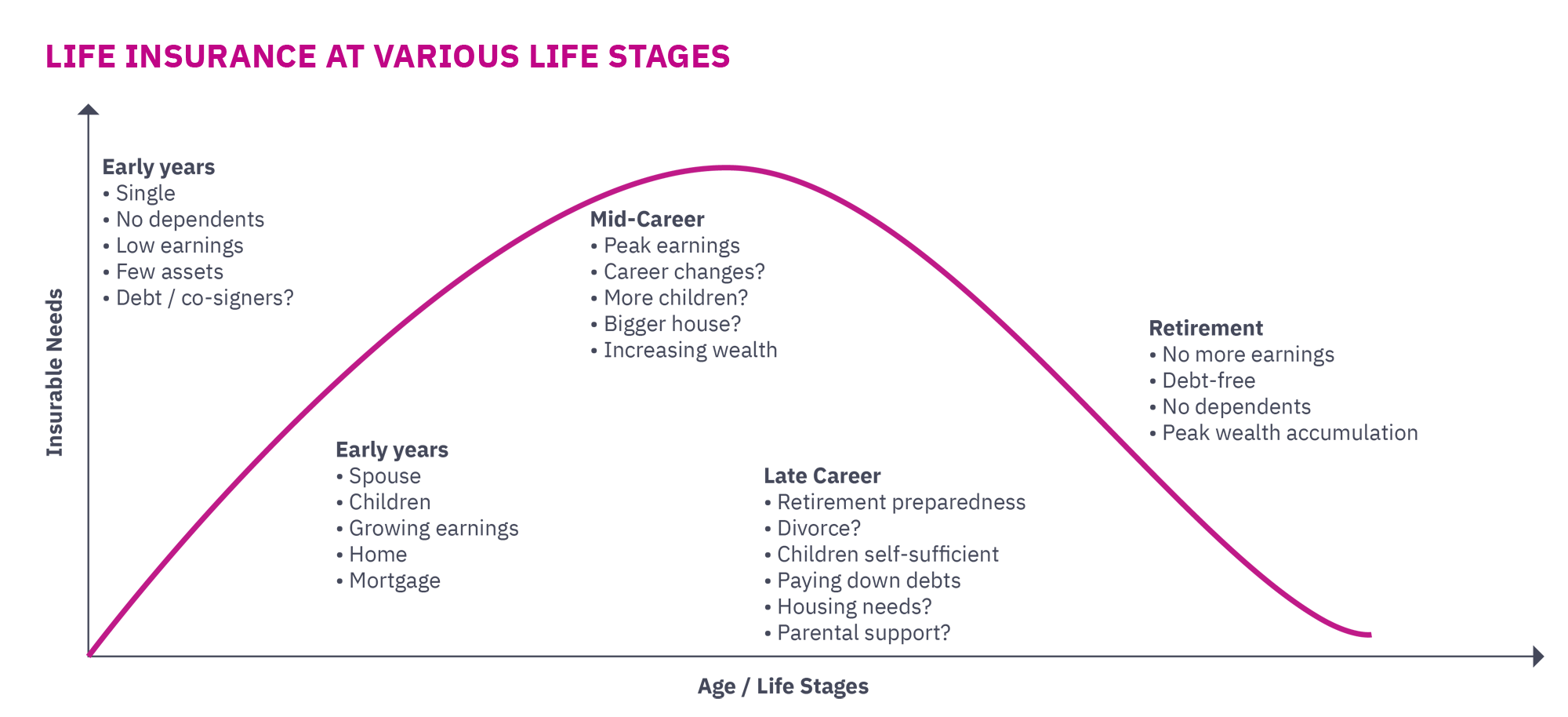

During your thirties and forties, it makes sense to focus on career and family in your daily life — building assets and managing household expenses. Planning for retirement in these earlier stages of life might not include anything more than contributing to an employer-sponsored 401(k) plan. But by age 50, if you haven’t already started, there are additional steps you should consider to help secure your financial future. And for different life stages, including ages 50-59 and forward, there will be evolving and changing financial needs to consider for retirement.

For instance, prior to turning age 60 is a good time to think about how you envision your retirement life, like where you will live and how you will spend your time. It’s also good to take advantage of catch-up contribution allowances for 401(k) accounts, individual retirement accounts (IRAs), and health savings accounts (HSAs). Before turning age 66, think about a realistic age to retire. Prepare by potentially adjusting tax and investment strategies as well as finalizing plans for health care and income replacement.

These life-stage checklists can serve as a guide to determine and help meet your objectives for financial success in retirement.

Ages 50-59

Ages 60-65

Ages 66-75

Age 76 and Older

We understand that your life story — and financial objectives — are unique to you and your family. Our advisors collaborate with you on a complete approach for your retirement years that blends investment advice, financial planning, estate planning, and tax strategies. In addition, our many years of experience helping clients has given us insight into how to navigate personal matters beyond finances, such as having difficult conversations with family members or finding a new purpose in retirement.

If you aren’t yet a Mercer Advisors client and want to learn more about achieving financial success in retirement, let’s talk.

1. Monthly Statistical Snapshot, Social Security Administration, February 2024.

2. “Best Health Insurance For Retirees Of 2024”, Forbes Advisor, January 3, 2024.

3. “Nearly 7 Million Americans Have Alzheimer’s, and Caregivers Are Stressed”, MSN HealthDay, March 20, 2024.

Mercer Advisors Inc. is a parent company of Mercer Global Advisors Inc. and is not involved with investment services. Mercer Global Advisors Inc. (“Mercer Advisors”) is registered as an investment advisor with the SEC. The firm only transacts business in states where it is properly registered or is excluded or exempted from registration requirements.

All expressions of opinion reflect the judgment of the author as of the date of publication and are subject to change. The information is believed to be accurate, but is not guaranteed or warranted by Mercer Advisors. Content, research, tools, and stock or option symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or to engage in any particular investment strategy. For financial planning advice specific to your circumstances, talk to a qualified professional at Mercer Advisors.

Certified Financial Planner Board of Standards, Inc. (CFP Board) owns the CFP® certification mark, the CERTIFIED FINANCIAL PLANNER™ certification mark, and the CFP® certification mark (with plaque design) logo in the United States, which it authorizes use of by individuals who successfully complete CFP Board’s initial and ongoing certification requirements.

The CDFA® and Certified Divorce Financial Analyst marks are the property of the Institute for Divorce Financial Analysts, which reserve sole rights to their use, and are used by permission.